|

Your Democracy

Friday, November 28, 2025 - 17:04

Source

This paper analyzes the historical genealogy of conspiracy theories about a global supergovernment by focusing on one period of American history in which it attained particular visibility. The formation of the United Nations in 1945 and the onset of the Cold War galvanized speculation on the political margins that a shadowy, malevolent international government was seeking world domination by targeting the United States and its political culture.

|

Renew Economy

Friday, November 28, 2025 - 15:04

Source

|

|

Renew Economy

Friday, November 28, 2025 - 14:59

Source

|

MacroBusiness

Friday, November 28, 2025 - 14:00

Source

Labor’s First Home Guarantee scheme, which commenced at the beginning of October, enables first home buyers to purchase a home with only a 5% deposit without requiring lenders’ mortgage insurance, with the government guaranteeing 15% of the mortgage. With Australian home values already the most expensive in history relative to household incomes, the First Home The post First home buyers risk waves of negative equity appeared first on MacroBusiness. |

|

MacroBusiness

Friday, November 28, 2025 - 13:30

Source

I cannot comment on the prospects of the latest deal, but we can run some scenario analysis to assess the outcomes. Goldman looks at oil. Brent crude prices have declined 5% over the past week to $62/bbl as the market reassesses the prospect of a potential Russia-Ukraine peace deal. While uncertainty around the details of The post What will a Ukraine peace deal do to commodities? appeared first on MacroBusiness. |

MacroBusiness

Friday, November 28, 2025 - 13:00

Source

Recall Labor’s Powering Australia Plan, released before the 2022 federal election, which claimed that it would cut NEM wholesale power rates by $11 per MWh (from $62 to $51) by 2025, resulting in lower retail power prices. Prime Minister Anthony Albanese hailed RepuTex Energy’s analysis as “the most comprehensive modelling ever done for any policy The post It’s time for honesty on the renewable energy future appeared first on MacroBusiness. |

|

MacroBusiness

Friday, November 28, 2025 - 12:30

Source

The Market Ear on stocks and fear. Panic gone The extreme VIX vs SPX gap is gone. Chart shows SPX vs VIX (inverted). Source: LSEG Workspace Downside panic also gone Downside protection has reset sharply lower during the latest bounce. The SDEX implosion has been agressive over the past days. Source: LSEG Workspace Seen VVIX? The post Fear recedes appeared first on MacroBusiness. |

Renew Economy

Friday, November 28, 2025 - 12:16

Source

|

|

MacroBusiness

Friday, November 28, 2025 - 12:00

Source

Recall that long-time immigration influencer Abul Rizi, who has forever championed a Big Australia and has ruthlessly attacked anybody arguing for lower immigration, amusingly endorsed the Canadian government’s sharp immigration cuts. In an article published on Independent Australia this month, Rizvi said the following about Canada’s immigration cuts: CONSISTENT WITH its announced long-term immigration plan |

Renew Economy

Friday, November 28, 2025 - 12:00

Source

|

|

MacroBusiness

Friday, November 28, 2025 - 11:30

Source

The larger the nation’s bureaucracy, the worse the policymaking. Data from the Australian Public Service Commission (APS) shows that the number of federal public servants increased by 7.4% in 2024-25, to a record high of 198,529. The public service headcount has increased by 24.7%—or 39,350 people—since Labor took office in May 2022. The APS report The post Bureaucratic bloat is crushing the economy appeared first on MacroBusiness. |

MacroBusiness

Friday, November 28, 2025 - 11:00

Source

In 2024, the NSW Productivity Commission warned that excessive housing costs were driving younger residents out of Sydney, resulting in a “brain drain” of 30- to 40 year olds. The NSW Productivity Commission found Sydney lost about 35,000 people aged 30-40 between 2016 and 2021. This week, Cotality released its September quarter housing affordability report, which The post No wonder families are leaving Sydney appeared first on MacroBusiness. |

|

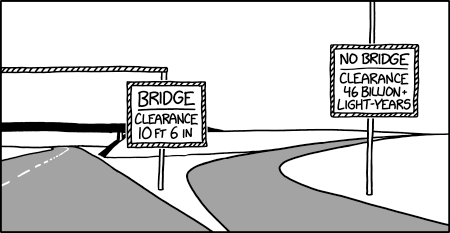

xkcd.com

Friday, November 28, 2025 - 11:00

Source

|

MacroBusiness

Friday, November 28, 2025 - 10:30

Source

The robots are coming for your job. Expected capex is through the roof. Via the ABS. Total capital expenditure Estimate 4 for 2025-26 is $191.3b This is 9.4% higher than Estimate 3 for 2025-26 In this very rare case, the outcome is not related to mining. It is AI. Whoa! Westpac is bullish for GDP. The post AI drives business investment boom appeared first on MacroBusiness. |

|

MacroBusiness

Friday, November 28, 2025 - 10:00

Source

There are some days when an economist can only shake his head in appalled wonder. After the shock jump in monthly inflation on Wednesday, Treasurer Jim Chalmers said the government was still weighing up whether to extend the federal subsidy that is due to expire next month. …National Australia Bank chief economist Sally Auld said The post Albo mulls gas export levy appeared first on MacroBusiness. |

MacroBusiness

Friday, November 28, 2025 - 09:30

Source

On Thursday morning, a press release from APRA with the headline: ‘APRA to limit high debt-to-income home loans to constrain riskier lending’ At first glance, it sounds perfectly reasonable, but once one begins to read into the details, it swiftly becomes clear that it is yet another one of APRA’s wet lettuce leaf approaches to The post APRA hits property investors with wet lettuce appeared first on MacroBusiness. |

|

Your Democracy

Friday, November 28, 2025 - 09:17

Source

|

MacroBusiness

Friday, November 28, 2025 - 09:00

Source

With Wall Street closed for Thanksgiving there wasn’t much of a boost for risk markets across the trading complex, with most stock indices finishing where they started and currencies holding on to their recent gains against the USD. The likely rate cut by the Fed in its December meeting is still in play with USD The post Macro Morning appeared first on MacroBusiness. |

|

Renew Economy

Friday, November 28, 2025 - 08:43

Source

|

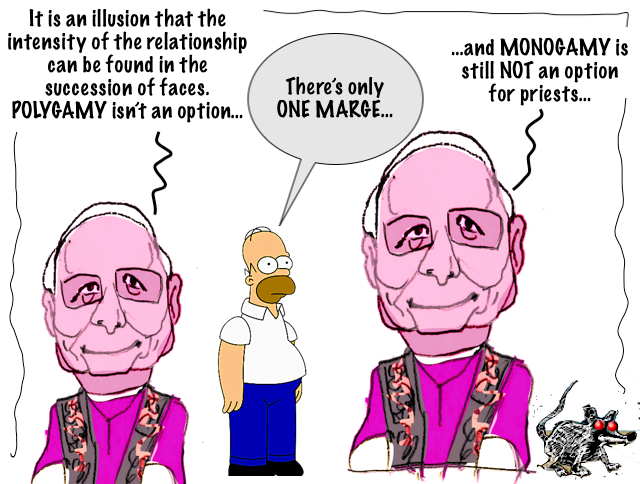

Your Democracy

Friday, November 28, 2025 - 08:00

Source

The Vatican has warned Catholics against polygamy, insisting that real marriage is a lifelong and exclusive union of one man and one woman. In a new doctrinal note backing monogamy signed by Pope Leo XIV and released on Tuesday, the Vatican rejected both polygamy and polyamory, saying these practices rely on “the illusion that the intensity of the relationship can be found in the succession of faces.” |

|

MacroBusiness

Friday, November 28, 2025 - 07:49

Source

DXY was soft overnight with US markets closed for Turkey Day. AUD firmed. CNY stable. The Japanese bust is contained by the Fed. Commodoties were weak without the Wall St inflation pump. EM stocks OK. Junk OK. Yields OK. Stocks closed. Societe Generale has the rub. The RBNZ inspired a big FX move overnight by The post Australian dollar “absurdly cheap” appeared first on MacroBusiness. |

Renew Economy

Friday, November 28, 2025 - 06:57

Source

|

|

Your Democracy

Friday, November 28, 2025 - 06:33

Source

As Palestinians face another winter of displacement and bombardment, Australia celebrates Christmas while ignoring its own obligations under international law. If recognition of Palestine is to mean anything, the government must act – not look away.

|

Your Democracy

Friday, November 28, 2025 - 06:00

Source

Ukraine is running out of men, having lost 47,500 troops in October while mobilizing only 14,000, Russian President Vladimir Putin stressed on Thursday. How do the facts on the ground affect the negotiating process? "The casualty trends are extremely negative for Kiev," National Defense magazine editor-in-chief Igor Korotchenko tells Sputnik. "But despite these highly unfavorable developments, the Zelensky regime continues the conflict with Western support." |

|

MacroBusiness

Friday, November 28, 2025 - 00:01

Source

This week saw the release of two important housing affordability reports from Cotality and Proptrack. Turning to Cotality’s report first, it showed that the median home price relative to median household income nationally hit a record high of 8.2 in Q3 2025, up from 6.4 five years earlier in Q3 2020. The amount of income The post The end of affordable housing in Australia appeared first on MacroBusiness. |

Your Democracy

Thursday, November 27, 2025 - 19:43

Source

While there is no denying that Europe during the last 500 years was the foundation of Western civilization and led the way in the industrial revolution and scientific advancements, it also created a bloody colonial legacy that produced incalculable human suffering across the globe.

Why Europe No Longer Matters by Larry C. Johnson

|

|

Renew Economy

Thursday, November 27, 2025 - 17:34

Source

|

Renew Economy

Thursday, November 27, 2025 - 17:31

Source

|

|

Your Democracy

Thursday, November 27, 2025 - 16:45

Source

Political analyst Rostislav Ishchenko explores how trade shapes the rise of states, the crisis of U.S. hegemony, and the birth of a new global order.

FRED TURNER, Editor

|

MacroBusiness

Thursday, November 27, 2025 - 16:30

Source

Asian equity markets are generally up with the lack of a lead tonight as Wall Street will be closed for thanksgiving (thanking the AI bubble that is stuffing the stock market turkey that it is). Movement has been more regional as Chinese markets react to the latest and slow industrial production numbers while locally capex The post Macro Afternoon appeared first on MacroBusiness. |